23+ Calculate loan to value

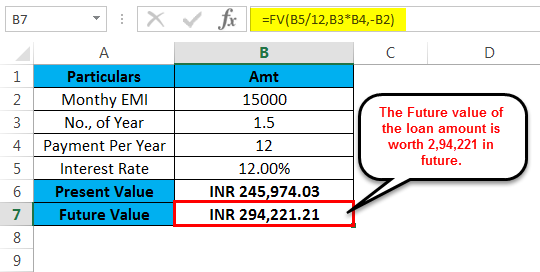

Pv means present value Input your principal amount borrowed here. The formula is shown.

Pv Function In Excel Formula Examples How To Use Pv

Line 14 attributable to those contributions.

. To calculate interest over the life of the loan enter 1 for start_period and your value for nper. With compounding we work out the interest for the first period add it the total and then calculate the interest for the next period and so on like this. Suppose your final income is 100000.

Learn the procedure to calculate tax deduction on loan repayment for house property and much more. However borrowers are permitted to use payroll. It is very difficult to calculate p-value manually.

From there you can solve for the future value. So make sure you write in the correct value of deductions while calculating your adjusted gross income. On fixed-rate loans lenders typically charge a higher interest rate for longer duration loans.

The greater the value of your deductions the lower the taxes you will have. Figure out the accounts opening balance and add up the value arrived in step 2 which shall be the average balance for that billing cycle period. E The chief appraiser may not in any tax year determine the depreciated.

For example if you have taken a loan of 500000 your loan schedule on excel will show a zero interest rate reducing the loan period and saving the rest of your money. After you apply the formula to calculate your home loan EMI the monthly instalment amount comes up to 27285. VA Net Value Factor - Effective - 12232015.

As of March 12 2021. Lastly to calculate interest outflow multiply the value arrived in step 3 by the rate of interest that was derived in step 1 which would be the line of credit payment of interest. Absolute Returns Absolute Return of a mutual fund refers to the amount of total change in the value of a mutual fund investment at the time of redemption.

Also offers loan performance graphs biweekly savings comparisons and easy to print amortization schedules. 1 lakh in a mutual fund scheme in January 2016. For example a lender might charge 509 for a 10-year fixed rate loan or 575 for a 15-year fixed rate loan.

In most cases this will be 0 and since it is an optional argument if you omit it the default value is 0. Calculation of home loan EMI is a simple method using an excel spreadsheet. How to File ITR Online India.

INTANGIBLES OF A SAVINGS AND LOAN ASSOCIATION. The lender charges interest as the cost to the borrower of well borrowing the money. Loan Overpayment Calculator Use our Loan Overpayment Calculator to see how overpaying your loan payment can reduce the total cost of your loan.

In a z-table the zone under the probability density function is presented for each value of the z-score. Interest Rate Applied 865. The net value factor is only published in the Federal Register when there is a change.

FVIFA is the abbreviation of the future value interest factor of an annuity. Our calculator includes amoritization tables bi-weekly savings. Effective December 23 2015 the factor will be 1595.

Loan Calculator Calculate the payments and total costs of one or more loans. Interest is easy to calculate. Pv is the amount of the loan or present value.

This is a result of the time value of money principle since money today is worth more than money tomorrow. It is a factor that can be used to calculate the future value of a series of annuities. Check out the webs best free mortgage calculator to save money on your home loan today.

You simply take the interest rate per period and multiply it by the value of the loan outstanding. CLTV All Loan Amounts Property Value LA 1 LA 2. 0 or omitted tells the function the payment is at the end of each period.

AY 2022-23 Income Tax Return ITR Filing FY 2021-22 AY 2022-23. Schedule F line 23 should be used in place of those respective lines on Schedule C. Assuming you have a 20 down payment 100000 your total mortgage on a 500000 home would be 400000For a 30-year fixed mortgage with a 35 interest rate you would be looking at a 1796 monthly payment.

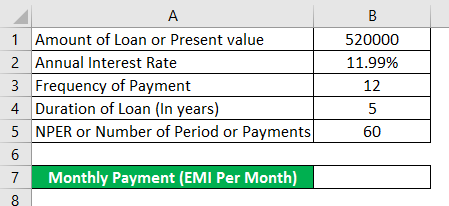

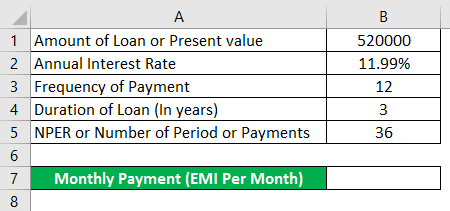

In order to calculate your monthly loan payment youll need to use the Excel loan payment formula for the PMT function. The most commonly employed way of doing this is to utilize a z-score table. If the following conditions are satisfied you can claim deduction us 80EE up to Rs.

How to calculate the Gross Annual Value of House Property. How to Calculate Home Loan EMI Using Excel Sheet. If you know you will pay your loan off quickly - before rates reset - then it may make sense to choose an adjustable rate option.

Type is an optional argument to define when the payment occurs. Past Net Value Rate Information - Posted 1222015. 50000 per year until the loan is repaid Value of the house should be Rs 50 lakhs or less A loan taken for the house must be Rs 35 lakhs or less The loan must be.

Lets Understand It Better with an Example. How to Use the. If omitted this value is assumed to be 0 meaning that the loan is paid off.

Calculate the depreciated value of the property by using a useful life that does not exceed 10 years. Use 0 or 1 to specify whether the payment is timed to occur at the beginning or end of the period. Now calculate your specific expenses from the last year.

There is no doubt that value of scheduling the extra payments depends upon the amount of frequency. Fv is the optional argument for future value. What is the formula to calculate p-value.

The value of the mutual fund invests stands at Rs. The Loan to Value Calculator uses the following formulas. LTV Loan Amount Property Value.

In addition to this you will be at peace of mind too finishing the loan. Beginning Value x 1 interest rate number of compounding periods per year years x number of compounding periods per. Fill it out and compute the value.

Estimate your monthly payments with PMI taxes homeowners insurance HOA fees current loan rates more. It is like paying interest on interest. As of March 12 2021.

P 3500000 R 865 N 30 years or 360 Months. Loan Payment Holiday Calculator Calculate how a payment holiday from your loan affects you. After a year Alex owed 100 interest the Bank thinks of that as.

Start_period and end_period represent your timeframe for calculating interest. Please keep in mind that the exact cost and monthly payment for your mortgage will vary depending its length and terms. Monthly EMI Rs 27285.

Where LTV is the loan to value ratio LA is the original loan amount PV is the property value the lesser of sale price or appraised value. Intangible property owned by a savings and loan association is appraised as provided by Section 89003. LA n Property Value.

Payroll costs used to calculate loan amounts. Like before this will be the term of your loan in year multiplied by 12 for monthly payments.

Free 6 Sample Mortage Loan Calculator Templates In Pdf

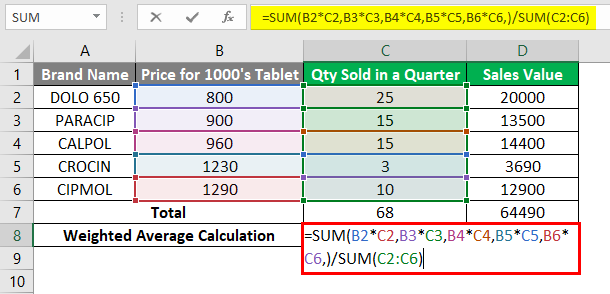

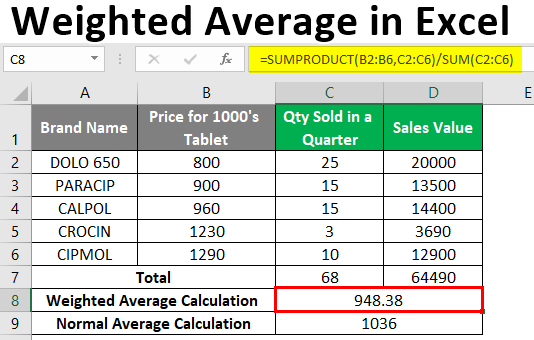

Weighted Average In Excel How To Calculate Weighted Average In Excel

Home Equity Loan Calculator Mls Mortgage Home Equity Loan Calculator Mortgage Amortization Calculator Home Equity Loan

Ppmt Function In Excel How To Use Ppmt Function In Excel

Free 7 Loan Calculator Excel Samples In Excel

Loan Constant Tables Double Entry Bookkeeping Mortgage Loans Mortgage Calculator Loan

Best 10 Mortgage Calculator Apps Last Updated September 2 2022

Free 7 Loan Calculator Excel Samples In Excel

Free 7 Loan Calculator Excel Samples In Excel

Mortgage Calculator Mortgage Calculator Reverse Mortgage Amortization Calculator Revers Mortgage Amortization Mortgage Amortization Calculator Online Mortgage

Weighted Average In Excel How To Calculate Weighted Average In Excel

Calculate Compound Interest In Excel How To Calculate

Free 6 Sample Mortage Loan Calculator Templates In Pdf

Ppmt Function In Excel How To Use Ppmt Function In Excel

Excel Mortgage Calculator How To Calculate Loan Payments In Excel

Free 6 Sample Mortage Loan Calculator Templates In Pdf

Can I Calculate Mortgage Payments With Online Tools Ask Dave Taylor In 2022 Mortgage Payment Mortgage Payment Calculator Mortgage